Chase Bank Online Banking Login, Chase Bank Sign Up - 23 April

With your Chase Bank online account, you can make payments, request an eStatement, and do a variety of other things that will save you time queuing at the bank. These services are provided for free and are only available to customers who enroll. This guide will teach you how to log in, reset your password if you forget it, and register for the Bank's online banking services.

HOW TO LOGIN

If you have signed up for internet banking, you can access your account at any time. Customers can also use their mobile web browsers or download Playstore and iTunes mobile apps. To gain access to your online account, follow these steps:

Step 1: Open your web browser and type in https://www.chase.com/ or click the link

Step 2: Enter your username and password and click ‘login’

| |

| Chase Bank Online Banking Login Step 2 | |

As long as you have used the correct login details, you will be granted access to your dashboard

HOW TO RESET YOUR PASSWORD CHASE BANK

The process of resetting your password is pretty simple if you have a valid user ID. You will be required to provide your user ID in order to register. Here are the steps to follow:

Step 1: Click the “CHASE” logo to navigate back to the Homepage

Step 2: Click “forgot username/password?”

|

| Chase Bank Forgot Password Step 2 |

Step 3: Enter your social security number

|

| Chase Bank Forgot Password Step 3 |

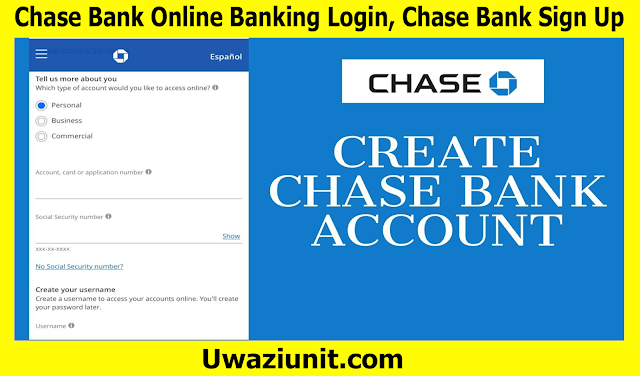

HOW TO SIGNUP

If you already have a Chase Bank account, you can easily register for an online account. You will also require an email address and a strong password to log in. If you want to enroll, here are the steps to take:

Step 1: Click “not enrolled? Sign up now?”

|

| Chase Bank Account Online Sign Up Step 1 |

Step 2: Choose whether you want to open a personal or business account

|

| Chase Bank Account Online Sign Up Step 2 |

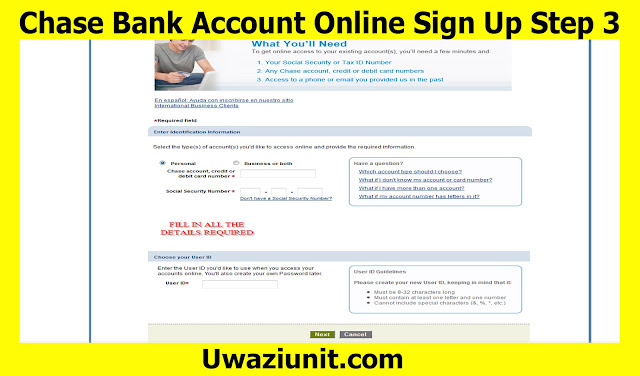

Step 3: Fill in the details and click “next”

|

| Chase Bank Account Online Sign Up Step 3 |

MANAGE YOUR CHASE BANK ONLINE ACCOUNT

Here are some of the benefits of having an online account with Chase Bank:

- Access your eStatements

- Check your balances and history of transaction

- View your e-bills and pay your bills

- Transfer funds to other accounts

- Stop payments

- 24/7 online customer support

CHASE BANK REVIEW

Chase Bank is a national bank that serves as the commercial and consumer banking subsidiary of JPMorgan Chase, a multinational banking and financial services holding company based in the United States. Until its merger with J.P. Morgan & Co. in 2000, the bank was known as Chase Manhattan Bank, which was formed in 1955 by the merger of The Manhattan Company and Chase National Bank.

In the United States, the bank has over 5,100 branches and 16,000 ATMs. JPMorgan Chase had 250, 355 employees in 2016 and branches in over 100 countries. The bank has approximately $2.49 trillion in assets and is one of the four largest banks in the United States.

Benefits

Aside from offering everything, what are other benefits of banking with Chase Bank? Here is a list of the most important benefits:

Great technology

- The bank has invested a lot of money and time in giving their customers an excellent technological experience. The bank’s website is easy to use and intuitive, and the same applies to its mobile apps. Users can use the mobile apps on the smartphones to make deposits of up to 2,000 USD per day, which is amazing for customers who are not near an ATM

- Speaking of technology, the bank incorporates all its customers’ accounts within the bank. For example, when a user pulls up his mobile account, they get instant access to their savings and checking account balances. They can wire money to a family or friend, or pay bills from their mobile devices.

- Chase banks also offers mobile alerts just like most large banks that provide mobile apps. This is very important as it helps customers to stay up to date with their finances by allowing them to know when their accounts are running low or when their paychecks get to their checking account. There is no doubt that these are indeed useful tools.

Great offers

- Many big banks are jumping on reward bandwagon at the moment and chase is one of them. Customers who create a Chase Checking Total account only need to deposit $25 when opening account and set up direct deposit to get a bonus if $150 added to their account. For those who open a Chase Savings account, they are only required to deposit $10,000 in 10 business days and maintain the same balance for 90 days to get a bonus of $100.

Low minimums

- You don’t need a lot of money to open an account with Chase bank. For example, to open a Chase checking account, you only need a minimum of $25.

Downsides

All banks have their own downsides, including those that have good reviews. Here are a few downsides of Chase Bank:

Low interest rates

- You will find that online-only banks streamline their services to offer high interest rates. The same cannot be said for brick-and-mortar banks like Chase Bank. As we speak, the APY for Chase’s savings account is only 0.01%.

Regional

- Although Chase bank is an international bank, they are not available everywhere. Before you open an account with Chase Bank, make sure that they are available in your region and ATMs are also available within your reach.

Account fees

- Although customers with Chase bank savings and checking account can avoid account fees, they are required to meet all the parameters in order to do so. You will find that other banks are offering free savings and checking accounts without any hoops required to jump through.

Mobile deposit limits are low

- If you are a contractor or business owner who often receives payment through check and loves the convenience of mobile deposits, you should certainly think twice about chase bank. Their daily limit for mobile deposits is only $2,000 and monthly limit is $5,000

- Those who have their paychecks regularly deposited in their accounts won’t see this as a problem. They can simply use mobile deposit for personal checks that they get once in a while.

open chase bank account online no deposit,chase bank login,chase bank online,chase bank checking account,open chase checking account,chase checking account login,chase bank customer service,chase online banking,bank of america login,chase bank customer service,u.s. bank login,chase credit card login,capital one login,chase bank phone number,american express login,chase bank saving account requirements,chase bank savings account,create chase bank account online,chase checking account,chase saving account minimum balance,chase bank savings account interest rate,chase transfer limit per month,open chase savings account,chase savings withdrawal limit, Chase Bank Online Banking Login, Chase Bank Sign Up - 23 April

Tags

chase bank checking account

chase bank login

chase bank online

chase savings

Login Banking

open chase bank account online no deposit

open chase checking account

open chase savings account